A Roadmap for Responsible Business Conduct

This blog originally appeared on the U.S. Dept. of Labor blog on April 3, 2024. About the Author: Thea Lee is the deputy undersecretary for

This blog originally appeared on the U.S. Dept. of Labor blog on April 3, 2024. About the Author: Thea Lee is the deputy undersecretary for

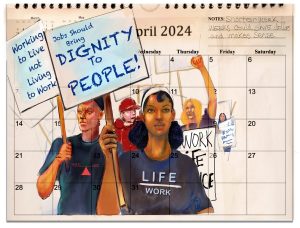

Work-life balance was on the autoworkers’ minds as the union prepared for bargaining — long hours, overtime and the mental health crisis.

Contrary to conventional wisdom, any type of worker, in any type of workplace, in any area can be convinced to organize.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

You must allow your physical and mental well-being to be the priority when you’re working your night job. Advocate for this.

A federal employee gives his account of how he used available resources to support his evolution from student to young professional.

This blog originally appeared on the U.S. Dept. of Labor blog on April 3, 2024. About the Author: Thea Lee is the deputy undersecretary for

Work-life balance was on the autoworkers’ minds as the union prepared for bargaining — long hours, overtime and the mental health crisis.

Contrary to conventional wisdom, any type of worker, in any type of workplace, in any area can be convinced to organize.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

You must allow your physical and mental well-being to be the priority when you’re working your night job. Advocate for this.

A federal employee gives his account of how he used available resources to support his evolution from student to young professional.

Copyright © 2024 Workplace Fairness, All rights reserved.

Madeline Messa is a 3L at Syracuse University College of Law. She graduated from Penn State with a degree in journalism. With her legal research and writing for Workplace Fairness, she strives to equip people with the information they need to be their own best advocate.